Real estate investors are facing a trend that is shifting the industry, one that demands adaptation for continued success and growth.

The Trend

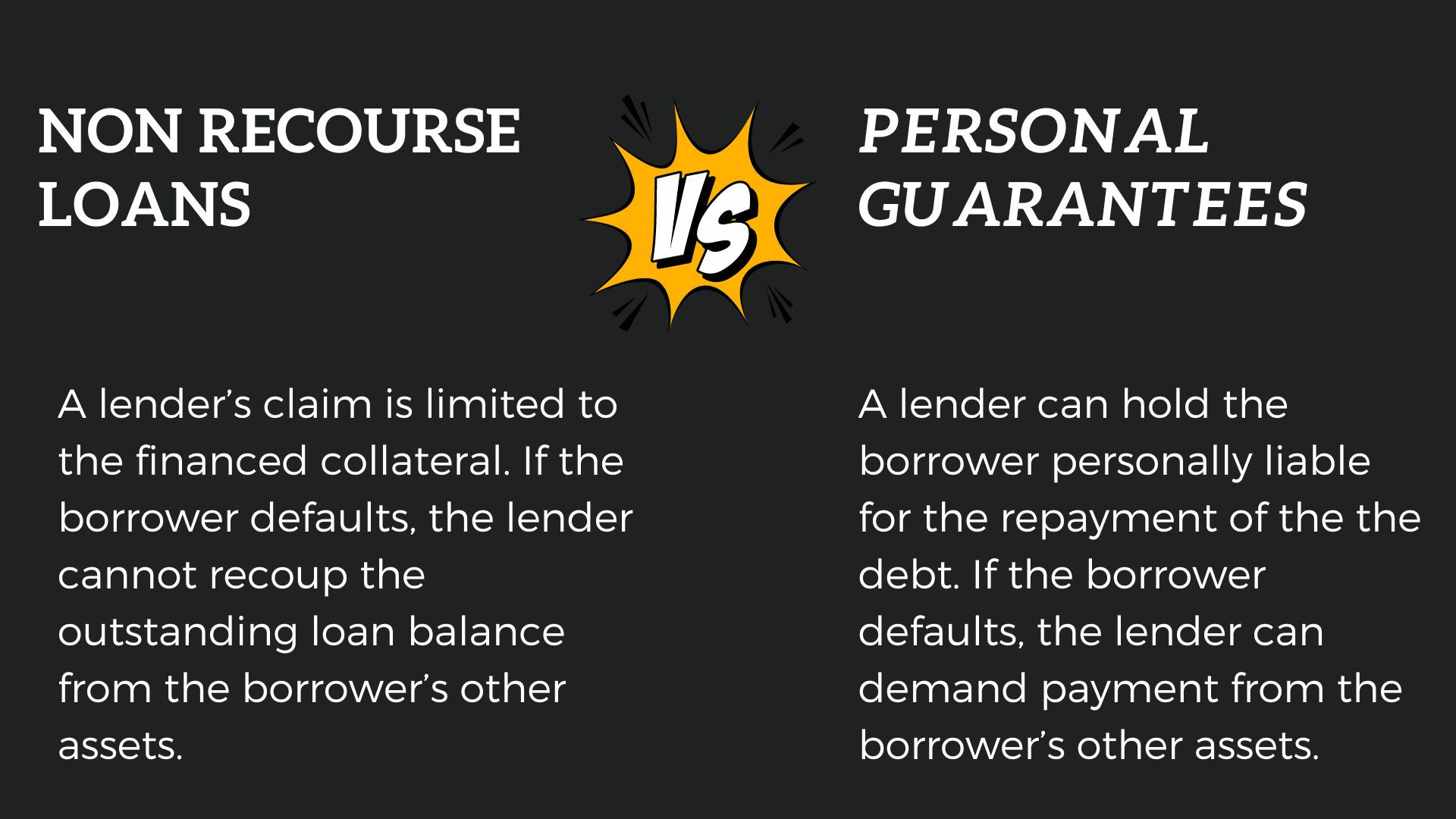

The trend toward banks requesting more personal guarantees and reducing non-recourse loans in commercial real estate financing signifies a significant shift in risk management strategies and lending practices:

- Risk Mitigation: Banks are becoming more risk-averse, seeking additional assurances by asking for personal guarantees. This ensures that in the event of default, the borrower's personal assets can be used to cover the outstanding debt, reducing the bank's risk exposure.

- Market Volatility: Economic uncertainties or fluctuations in property values can prompt lenders to reduce non-recourse loans. Non-recourse loans limit the lender's ability to seize assets beyond the collateralized property in case of default. By requesting personal guarantees, lenders add a layer of security in uncertain market conditions.

- Lender Confidence: Personal guarantees provide banks with more confidence in the borrower's commitment to the investment. It shows a willingness to stand behind the project with personal assets, strengthening the borrower's credibility in the eyes of the lender.

- Impact on Borrowers: Increased personal guarantees affect borrowers by exposing their personal assets to potential risks associated with the investment. This shift might impact investors' risk appetite, requiring more careful consideration before taking on loans backed by personal guarantees.

- Availability of Financing: The reduced availability of non-recourse loans might limit financing options for certain investors or projects. It could also affect the amount of leverage investors can utilize, potentially impacting their ability to undertake larger projects.

Navigating Through It

Navigating these changes in lending practices requires careful evaluation of risk and understanding the implications for borrowers:

- Diversification: Investors might consider diversifying their portfolios to spread risk across various investments and limit the exposure of personal assets.

- Negotiation and Due Diligence: Engaging in negotiations with lenders and thoroughly assessing the terms and conditions of loans becomes crucial. Understanding the implications of personal guarantees and exploring alternative financing options is vital.

- Stress Testing: Conducting stress tests to evaluate the potential impact of market fluctuations on investments becomes more important than ever.

As banks continue to adjust their lending criteria, staying informed, adapting strategies, and seeking expert advice can help investors navigate these changing dynamics in the commercial real estate lending landscape.

Banks in commercial real estate are increasingly demanding higher initial equity contributions, more personal guarantees, and fewer non-recourse loans. These shifts aim to mitigate risk in uncertain markets, offering lenders greater security while impacting investors' risk exposure and financing options. Investors must adapt strategies, diversify portfolios, and thoroughly assess loan terms to navigate these evolving lending practices effectively.