Evaluating Loan Covenants

Hey, gang, this is Greg Barron, aka The Professor. We're going to talk about financial modeling in one specific asset class called build to rent. This phenomena has really swept the country in the last couple of years in this post pandemic era. I am going to use a build to rent project I am working on to show why investors need to grasp these four basic components loan covenants are demanding.

Data is showing Gen Z and millennials are preferring to rent rather than owning big assets. So let's talk about a small project that I was just evaluating. I want to find out if we developed all of these as a build to rent, then ultimately exited in about five years, what would the original investment look like? And more importantly, what would the exit look like as a return on our investment?

Before I show you a loaded proforma in ProformaPlus, a real estate online platform, I want to talk to you about four major changes in lending covenants that we're going to center on today that we can evaluate, and these are going to determine whether we get a thumbs up or a thumbs down at the end of the day for this project.

The Four Basic Components Loan Covenants Demand

There's four basic things that loan covenants are demanding these days. We're no longer in the days of 25% down on a commercial investment. We're anywhere from 35% to 50% down on most deals that we're looking at. So in talking to my bankers and getting term sheets, there's four major issues that I'm having to deal with in our new developments.

1. Increased Equity Contribution

The shift from a typical 25% equity investment to a higher requirement of 35% or even upwards of 50% marks a significant change in real estate financing. Several factors contribute to this shift.

2. Increased Reserve Requirements

Reserve requirements refer to the minimum amount of funds that financial institutions, such as banks or lending organizations, must hold in reserve against their liabilities. These requirements are set by regulatory authorities and are aimed at ensuring financial stability and protecting against economic downturns.

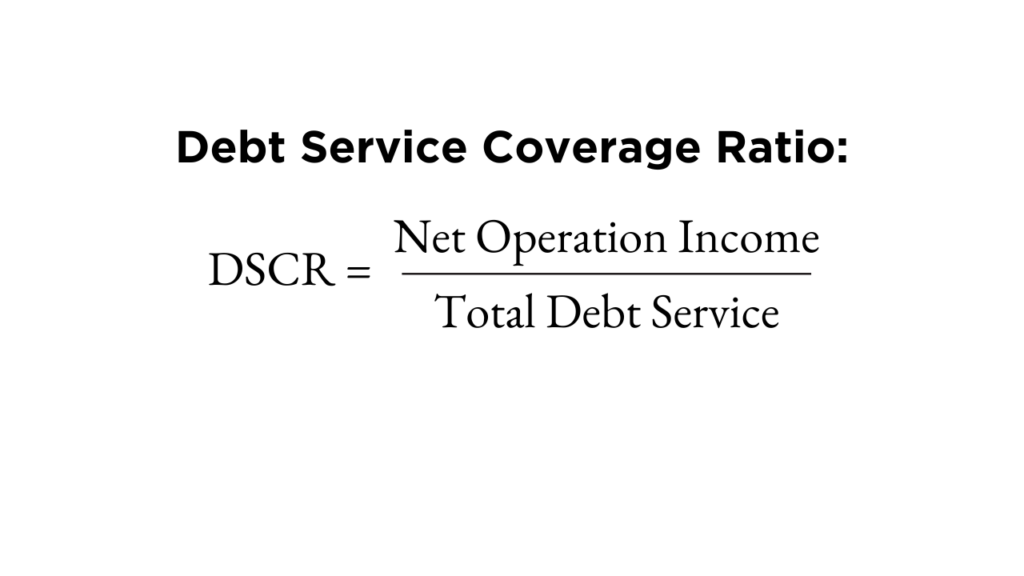

3. Debt Coverage Ratio

The Debt Service Coverage Ratio (DSCR) is a vital financial metric used in real estate and commercial property investment. It measures a property's ability to generate enough income to cover its debt obligations. A DSCR of 1.3 means that the property's net operating income is 1.3 times its debt service (the amount needed to cover interest and principal payments).

4. Personal Guarantees

Banks are asking for more personal guarantees and less non-recourse loans in commercial real estate. This trend toward banks requesting more personal guarantees and reducing non-recourse loans in commercial real estate financing signifies a significant shift in risk management strategies and lending practices.

In Summary

Lending covenants are stipulations set by lenders to borrowers, outlining specific conditions and requirements that must be met throughout the loan term. These conditions often include financial ratios, collateral maintenance, restrictions on additional borrowing, and requirements for reporting financial information. Lenders use covenants to mitigate risks, ensure loan repayment, and safeguard their interests. Borrowers must adhere to these covenants to maintain loan compliance and avoid potential penalties or default. Understanding and meeting these conditions are crucial for borrowers to uphold a healthy lender-borrower relationship and secure continued access to financing.